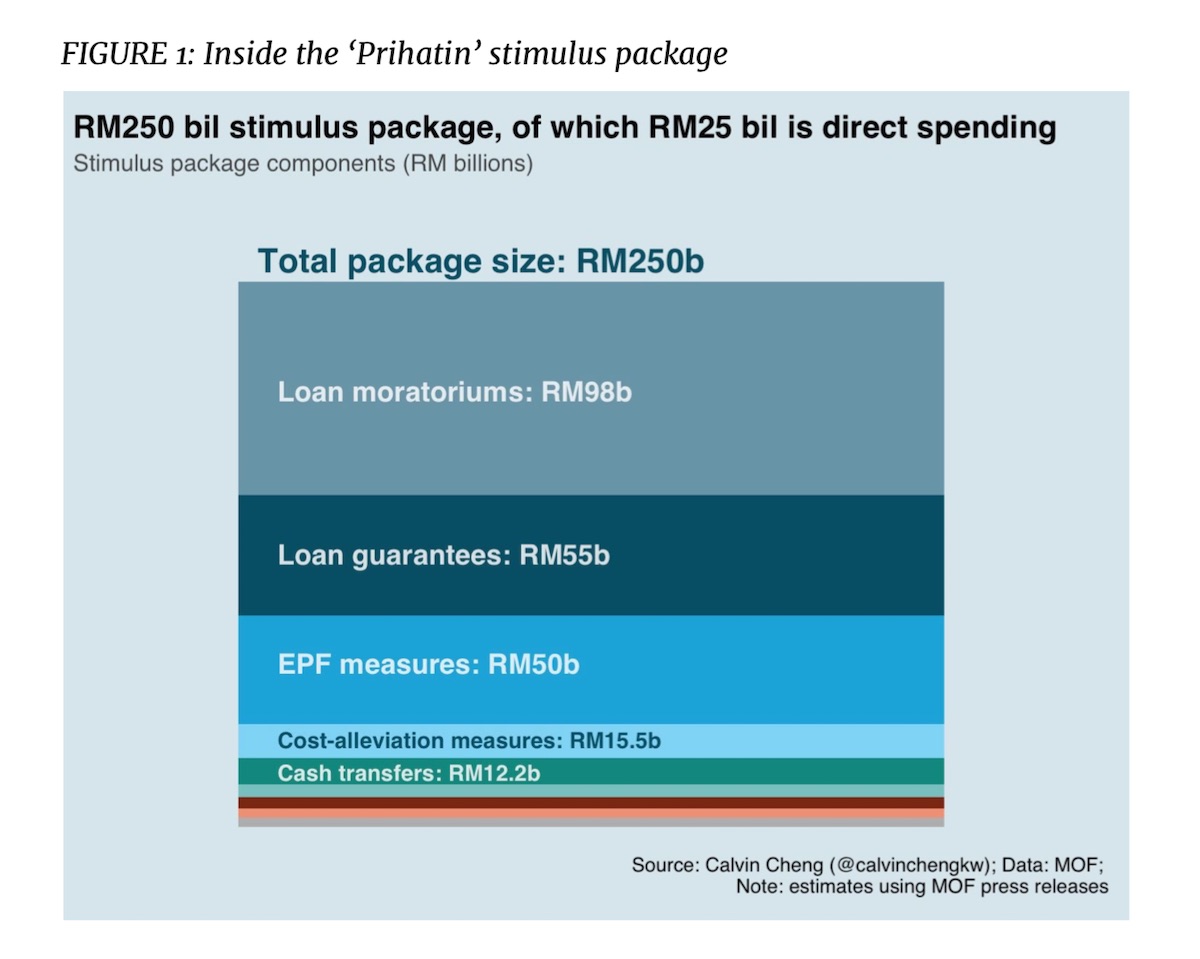

The PN administration announced the Prihatin economic stimulus package (Pakej Ransangan Ekonomi Prihatin Raykat) on 28 March 2020, exactly one month after the first stimulus package was announced in February. Combined with the previous stimulus, the total Prihatin package is worth RM250 billion. Out of the total RM250 billion package, an estimated RM25 billion is direct government spending, and about half of this spending (RM12 billion) is for cash transfers to households and individuals.

What are the main cash transfer components?

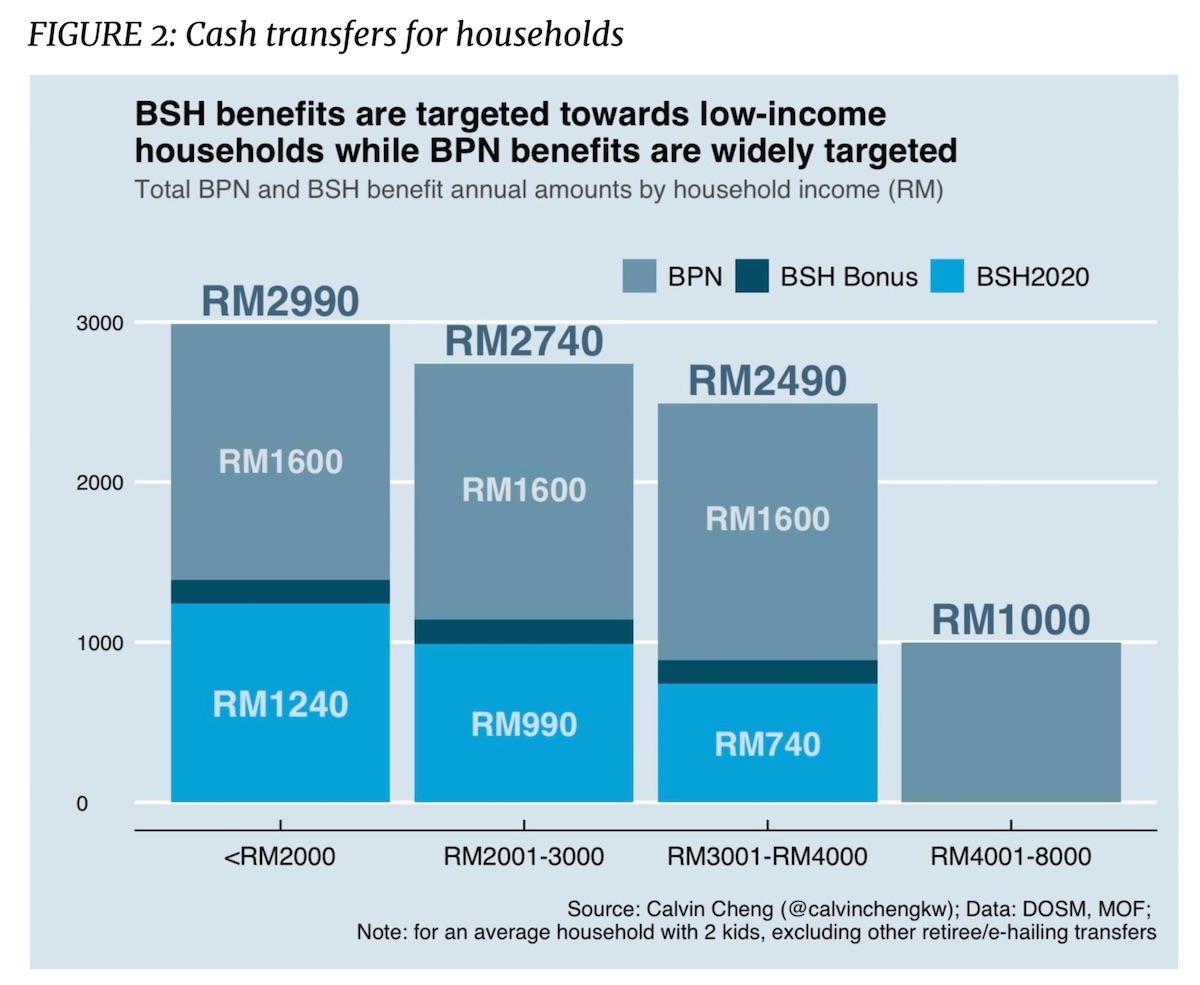

For households, the main cash transfer component primarily consists of Bantuan Prihatin Nasional (BPN), an unconditional income-targeted cash transfer, which is essentially a one-off supplement to the normal Bantuan Sara Hidup (BSH) cash transfers. However, while BSH is targeted towards lower-income households, BPN is widely targeted, covering up an estimated 66 percent of all households in the country. Combined, the BPN/BSH programmes transfer about RM2,990 for the whole year for households earning below RM2,000 per month (see Figure 2).

Here, I focus primarily on the BPN/BSH transfers as these are income-targeted compared to the more narrowly targeted transfers for e-hailing and taxi drivers (RM500), civil servants (RM1,000) and government pensioners (RM500).

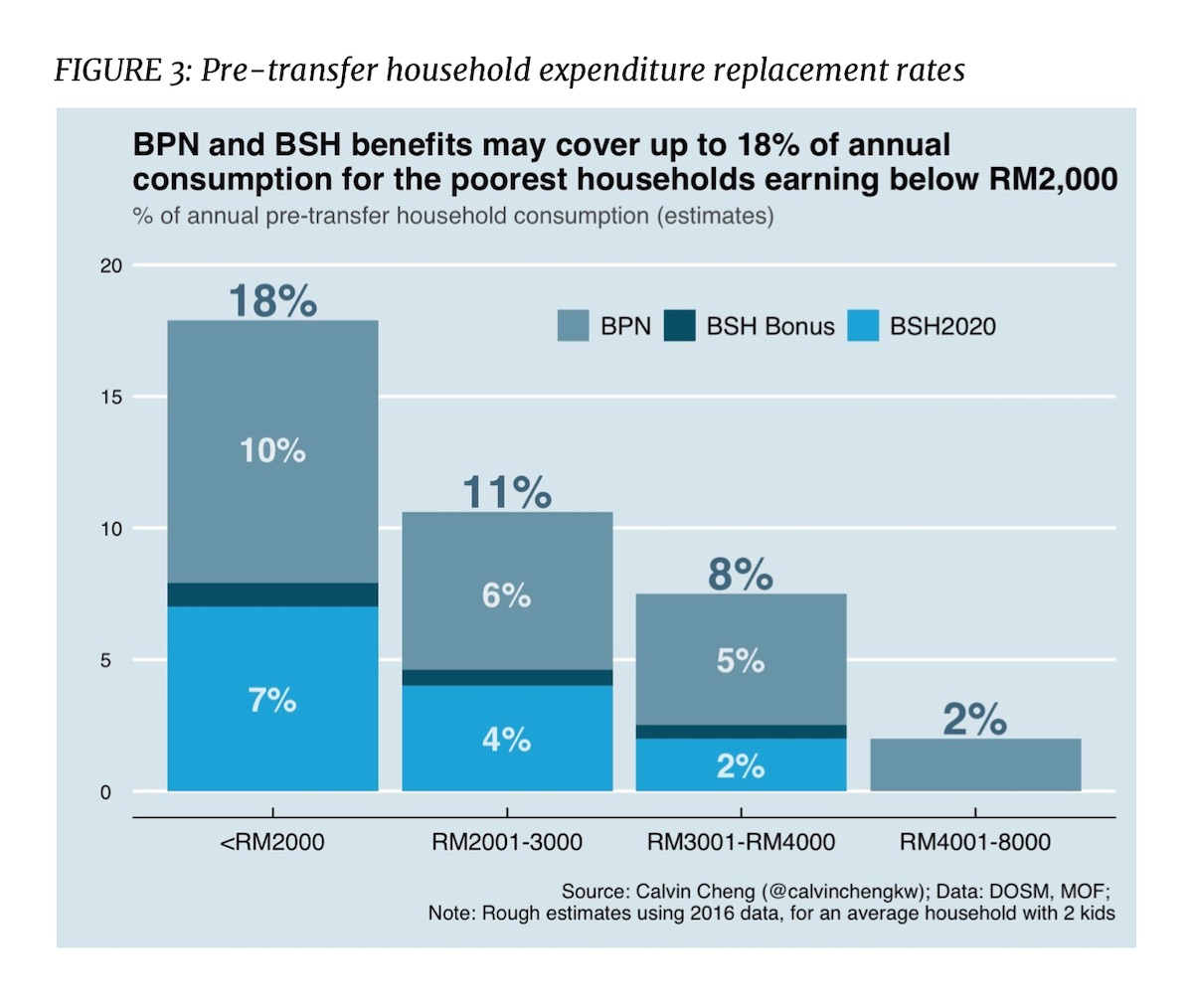

Overall, from household expenditure survey data, I estimate that the BPN/BSH benefits have an expenditure replacement rate of about 18 percent for the lowest income households (those earning below RM2,000 per month). Put differently, the BPN/BSH transfer is estimated to cover about 18 percent of the annual household consumption for a household earning below RM2,000 a month, and about 11 percent of the consumption for a household earning between RM2,001 and RM3,000 a month (see Figure 3).

Overall, from household expenditure survey data, I estimate that the BPN/BSH benefits have an expenditure replacement rate of about 18 percent for the lowest income households (those earning below RM2,000 per month). Put differently, the BPN/BSH transfer is estimated to cover about 18 percent of the annual household consumption for a household earning below RM2,000 a month, and about 11 percent of the consumption for a household earning between RM2,001 and RM3,000 a month (see Figure 3).

Are these BPN/BSH transfers enough?

Research suggests that the combined BPN/BSH expenditure replacement rate of close to 20 percent is in line with international best practices for benefit sizes for cash transfer programmes. If nothing more, it provides a much needed increase from the usual BSH benefits, which only covers about 7 percent of annual household expenditures. The additional BPN benefits more than double the usual benefits received by households earning below RM2,000/month.

Yet, while these benefit sizes may be adequate as an income supplement in normal circumstances, these are certainly not normal times. Indeed, stakeholder engagement suggests the movement controls have had disproportionately devastating effects on lower-income communities, with many reporting zero incomes during the MCO period. This is an emergency and, therefore, cash transfers for low-income families may need to be more generous, at least temporarily.

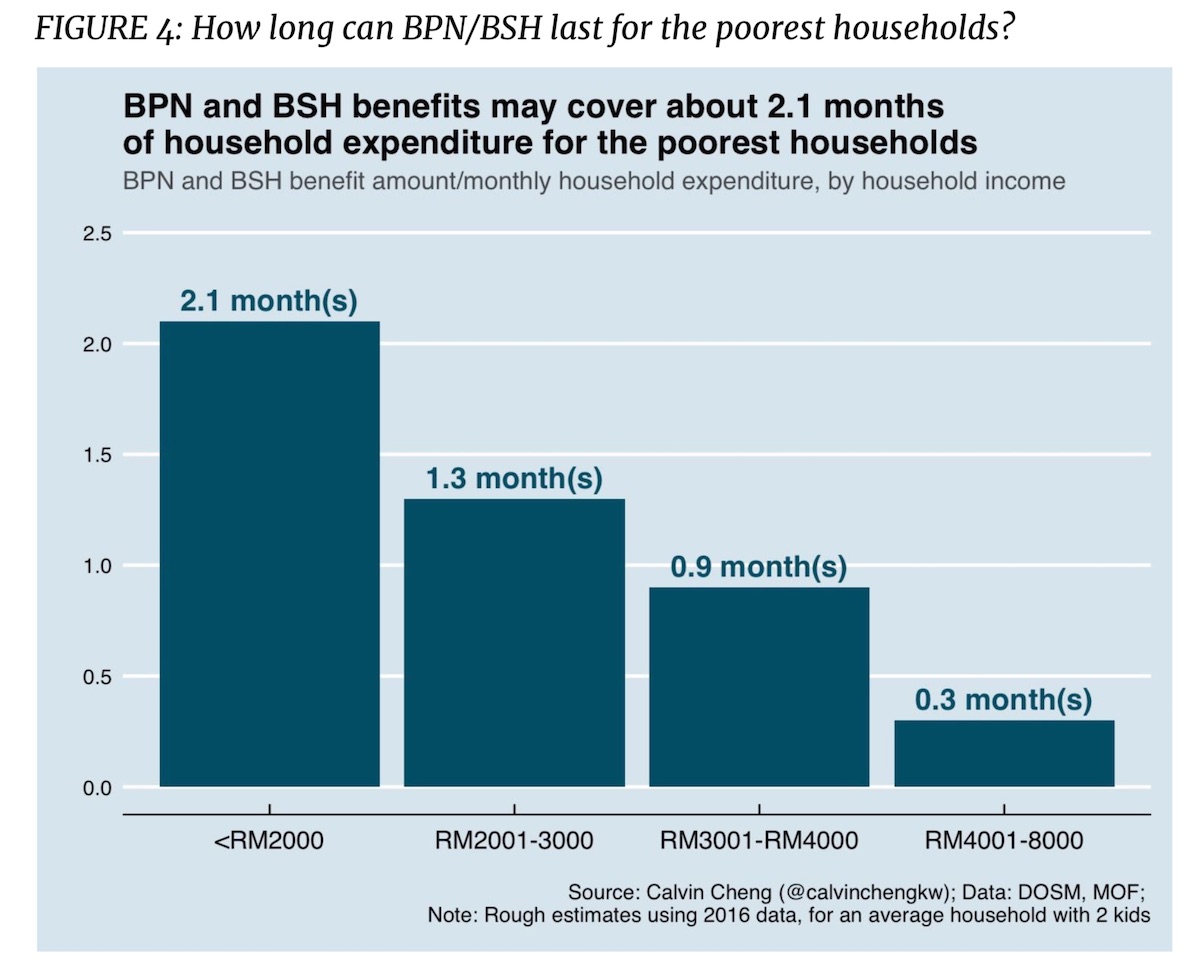

Assuming the transfers fully replace household expenditure, I estimate that BPN/BSH benefits translate to about 2 months of full expenditure coverage for RM2,000/month households and about 1 month of full expenditure coverage for RM2,001-RM3,000/month households using household survey data (see Figure 4). One caveat is that this estimate does not take into account potential reductions in household expenditures from Prihatin package’s cost-alleviation measures, including the moratorium on loan repayments and discounts on utility bills.

So, what can be done?

Overall, BPN/BSH benefits will need to be supplemented to ensure adequate income support for distressed households, particularly if the MCO measures are extended and/or if economic conditions worsen. If conditions warrant, the next BPN supplement (BPN2) should fully cover at least another 2 months worth of household expenditures for the lowest income households (those with earnings below RM2,000/month). According to my estimates, this implies an additional BPN2 transfer of RM2,800, though BPN2 can be more narrowly targeted towards households earning below RM4,000/month.

Additionally, while the logistical similarities between the BPN and BSH cash enable policymakers to leverage on existing BSH infrastructure and get funds out more quickly, this also means that the BPN transfers may inherit some of the existing weaknesses of the BSH programme.

As such, policymakers should work towards mending some of these shortfalls. Chief of this will be reducing exclusion errors in BSH targeting. That is, reducing the number of people who would ordinarily meet BSH eligibility requirements, but are left out of receiving benefits. This would entail reducing targeting errors by moving towards targeting per-capita household incomes rather than aggregate household incomes – and reducing exclusion errors in certain communities by increasing programme outreach and reducing information asymmetries.

Broadly, minimising targeting exclusion errors while exercising a higher tolerance for inclusion errors will limit the number of qualifying families that fall through the cracks. This is crucial as the BPN/BSH transfers represent the “floor” for the Prihatin stimulus package. Informal or self-employed workers, who may not qualify for PERKESO’s slew of measures (EIS, ERP, wage subsidies), will hope to at least receive some assistance via the BPN/BSH transfers.

Nevertheless, it is important to note that economic policy at this stage should not be focused on stimulating the economy. Rather, it should take a backseat to public health measures to contain the pandemic and play a supportive role by safeguarding the welfare of families and businesses. Save the fiscal firepower for later. After all, once the infection curve has flattened and movement restrictions are lifted, we are going to need a truly massive push to kickstart the recovery.