The 2021 Budget, along with 2021 Fiscal Outlook and Revenue Estimates was proposed by the Finance Minister on 6 November 2020. This article takes a quick look at the federal government’s fiscal position and growth projections, along with some initiatives in the Budget related to social assistance, TVET, digitalisation, and automation.

By

Calvin Cheng

Analyst

Economics, Trade & Regional Integration

calvin.ckw@isis.org.my

Dr Juita Mohamad

Fellow

Economics, Trade & Regional Integration

juita.mohamad@isis.org.my

1.0 Overview of government fiscal position and growth projections

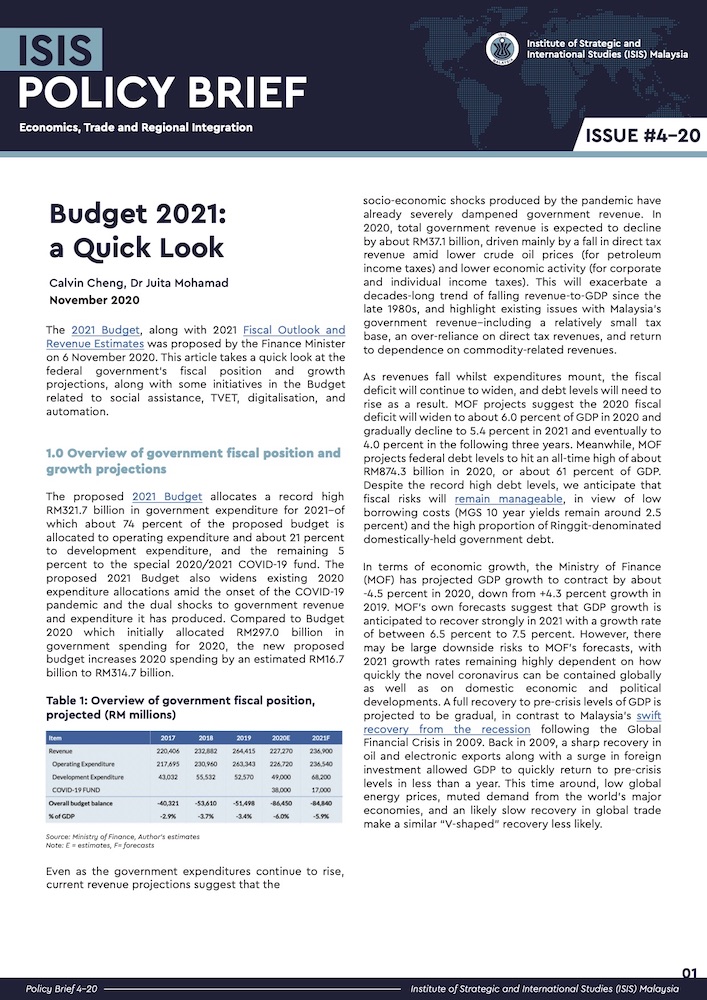

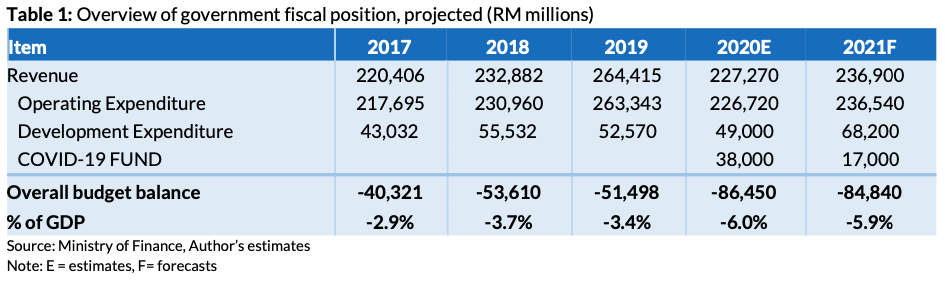

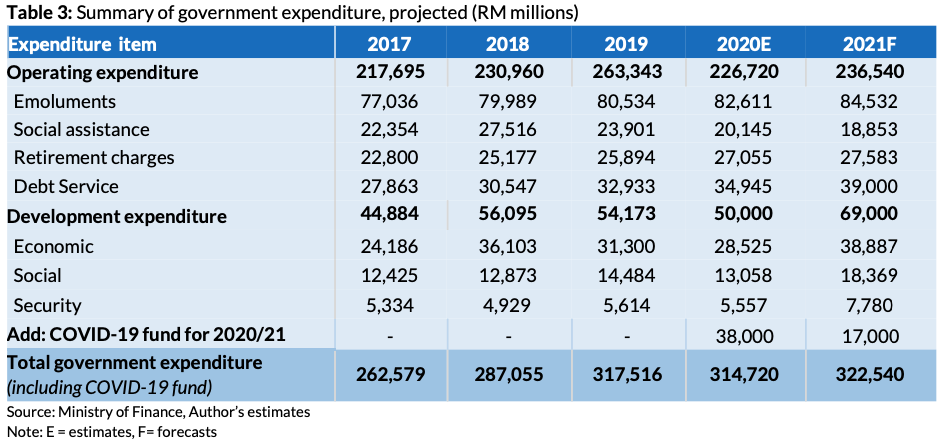

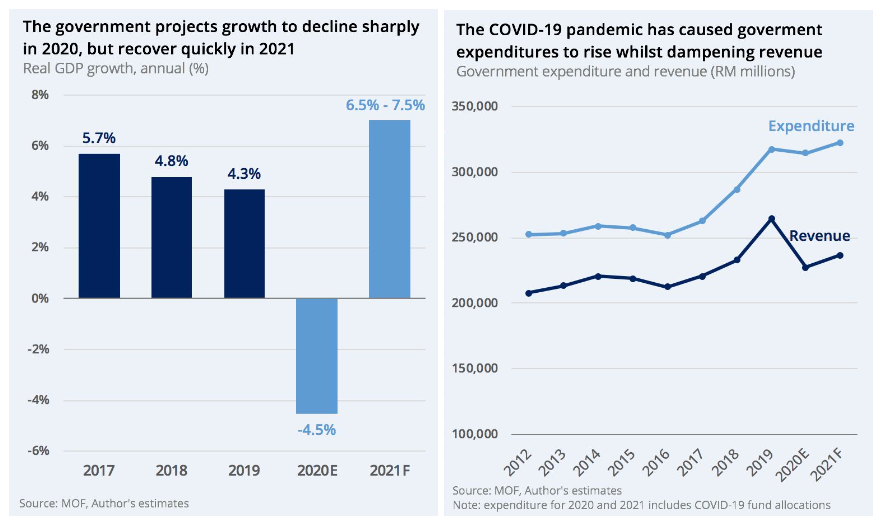

The proposed 2021 Budget allocates a record high RM321.7 billion in government expenditure for 2021–of which about 74 percent of the proposed budget is allocated to operating expenditure and about 21 percent to development expenditure, and the remaining 5 percent to the special 2020/2021 COVID-19 fund. The proposed 2021 Budget also widens existing 2020 expenditure allocations amid the onset of the COVID-19 pandemic and the dual shocks to government revenue and expenditure it has produced. Compared to Budget 2020 which initially allocated RM297.0 billion in government spending for 2020, the new proposed budget increases 2020 spending by an estimated RM16.7 billion to RM314.7 billion.

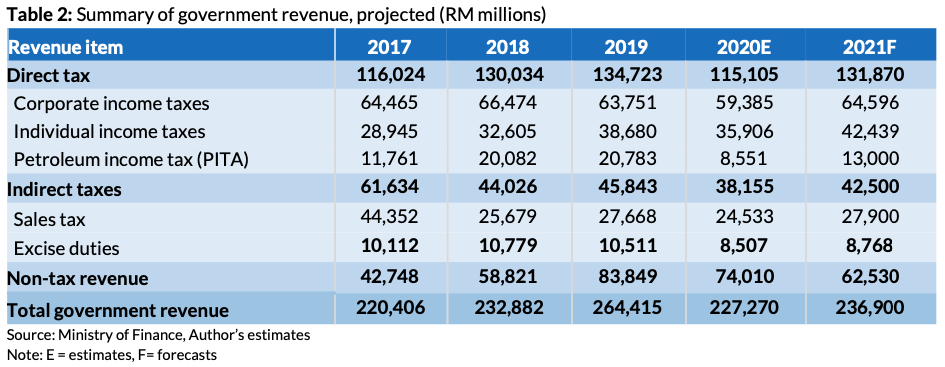

Even as the government expenditures continue to rise, current revenue projections suggest that the socio-economic shocks produced by the pandemic have already severely dampened government revenue. In 2020, total government revenue is expected to decline by about RM37.1 billion, driven mainly by a fall in direct tax revenue amid lower crude oil prices (for petroleum income taxes) and lower economic activity (for corporate and individual income taxes). This will exacerbate a decades-long trend of falling revenue-to-GDP since the late 1980s, and highlight existing issues with Malaysia’s government revenue–including a relatively small tax base, an over-reliance on direct tax revenues, and return to dependence on commodity-related revenues.

Even as the government expenditures continue to rise, current revenue projections suggest that the socio-economic shocks produced by the pandemic have already severely dampened government revenue. In 2020, total government revenue is expected to decline by about RM37.1 billion, driven mainly by a fall in direct tax revenue amid lower crude oil prices (for petroleum income taxes) and lower economic activity (for corporate and individual income taxes). This will exacerbate a decades-long trend of falling revenue-to-GDP since the late 1980s, and highlight existing issues with Malaysia’s government revenue–including a relatively small tax base, an over-reliance on direct tax revenues, and return to dependence on commodity-related revenues.

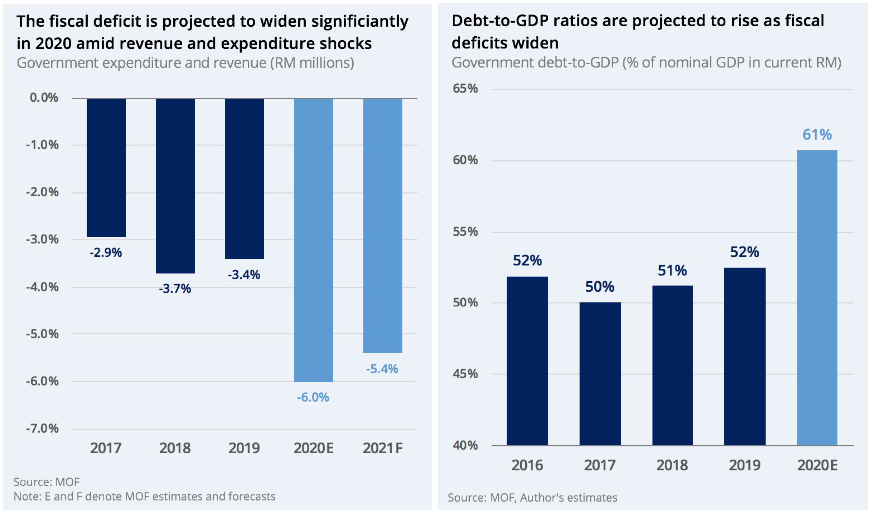

As revenues fall whilst expenditures mount, the fiscal deficit will continue to widen, and debt levels will need to rise as a result. MOF projects suggest the 2020 fiscal deficit will widen to about 6.0 percent of GDP in 2020 and gradually decline to 5.4 percent in 2021 and eventually to 4.0 percent in the following three years. Meanwhile, MOF projects federal debt levels to hit an all-time high of about RM874.3 billion in 2020, or about 61 percent of GDP. Despite the record high debt levels, we anticipate that fiscal risks will remain manageable, in view of low borrowing costs (MGS 10 year yields remain around 2.5 percent) and the high proportion of Ringgit-denominated domestically-held government debt.

In terms of economic growth, the Ministry of Finance (MOF) has projected GDP growth to contract by about -4.5 percent in 2020, down from +4.3 percent growth in 2019. MOF’s own forecasts suggest that GDP growth is anticipated to recover strongly in 2021 with a growth rate of between 6.5 percent to 7.5 percent. However, there may be large downside risks to MOF’s forecasts, with 2021 growth rates remaining highly dependent on how quickly the novel coronavirus can be contained globally as well as on domestic economic and political developments. A full recovery to pre-crisis levels of GDP is projected to be gradual, in contrast to Malaysia’s swift recovery from the recession following the Global Financial Crisis in 2009. Back in 2009, a sharp recovery in oil and electronic exports along with a surge in foreign investment allowed GDP to quickly return to pre-crisis levels in less than a year. This time around, low global energy prices, muted demand from the world’s major economies, and an likely slow recovery in global trade make a similar “V-shaped” recovery less likely.

Fig 1: Overview of government fiscal position and growth projections

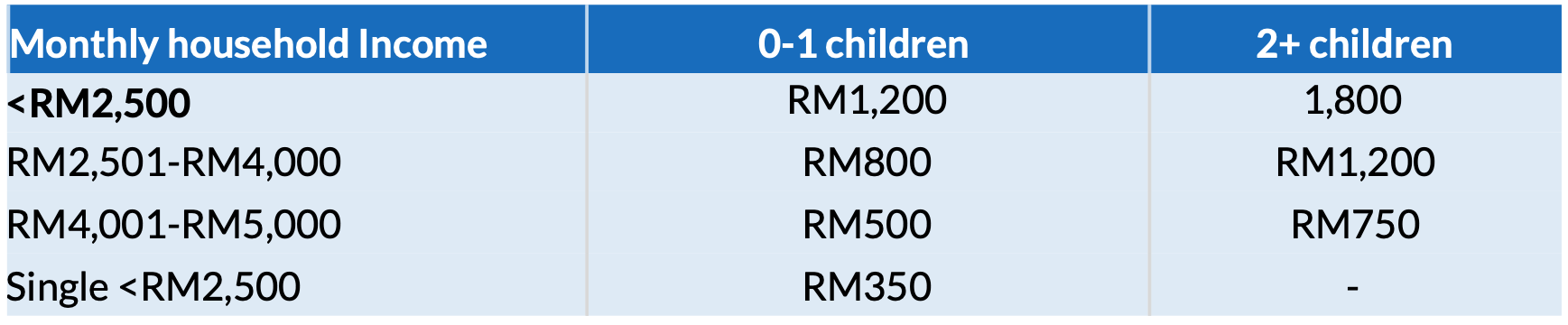

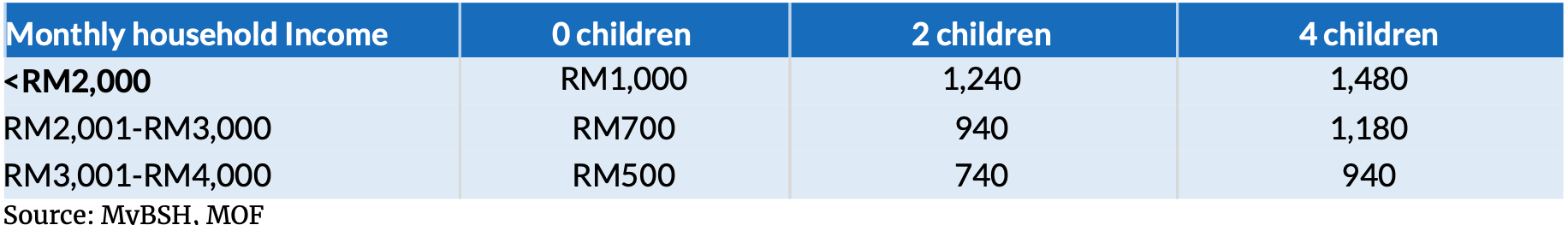

2.0 Social assistance and EPF-related initiatives

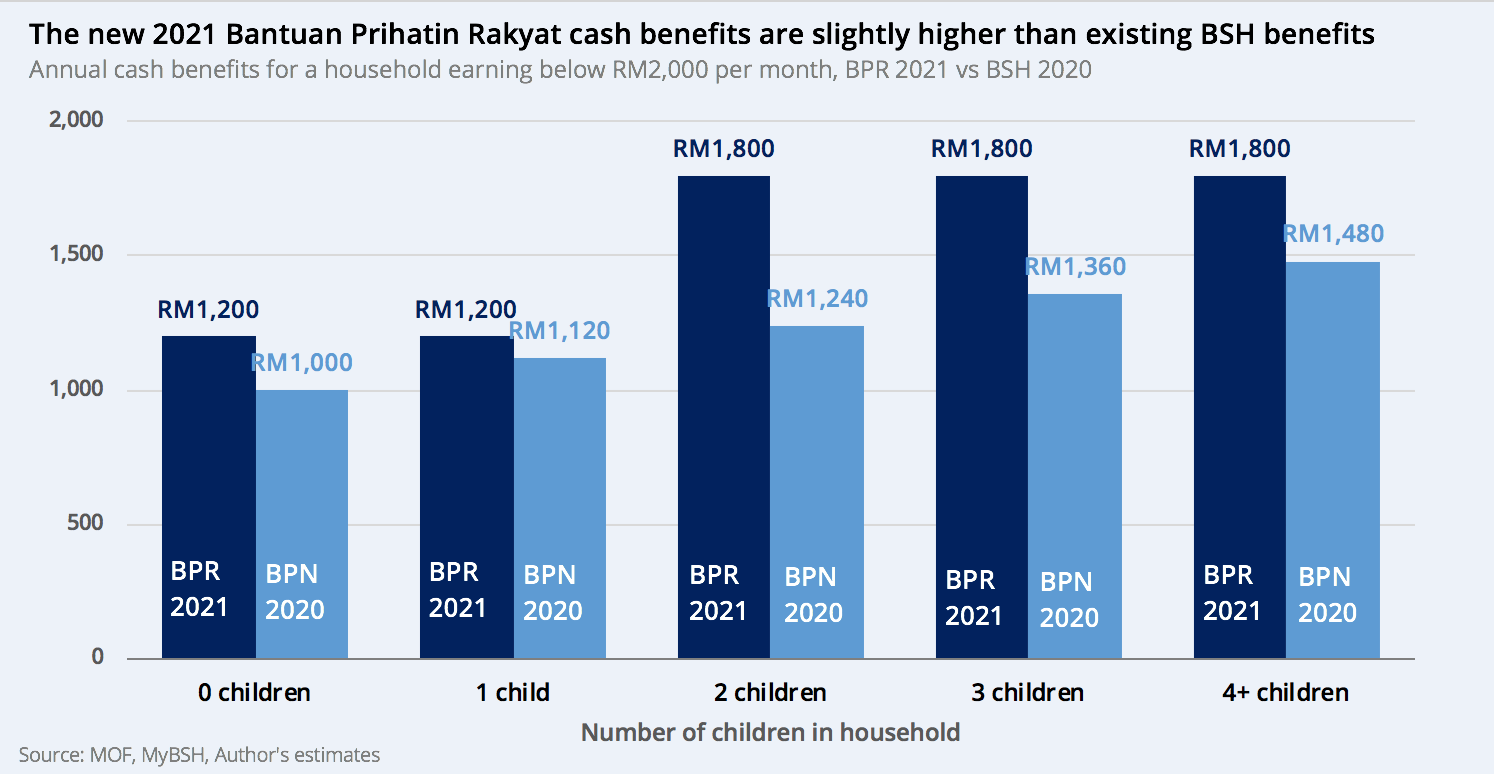

Budget 2021 also proposes the Bantuan Prihatin Rakyat (BPR) income-targeted cash transfer program, which is intended to replace the existing Bantuan Sara Hidup (BSH) program in 2021. BPR will have a proposed total allocation of RM6.5 billion and is expected to reach 8.1 million beneficiaries, compared to a RM5.0 billion allocation for the BSH program. The BPR cash benefits are also more widely-targeted compared to BSH, targeting households earning up to RM5,000 per month. At the same time, the supplementary Bantuan Prihatin Nasional (BPN) cash assistance program, introduced in the Prihatin economic recovery package will continue to run on top of the BPR program in 2021.

Nonetheless, as the BPR is based largely off of the existing BSH/BPN infrastructure, there remains much room to improve these cash transfer programs to maximise program impacts. This would entail working towards mending existing weaknesses in Malaysia’s cash transfer programs like the relatively high targeting inclusion and exclusion errors, and the eligibility income requirements that do not scale with household size.

Table 4: Bantuan Prihatin Rakyat 2021 benefit schedule

Table 5: Bantuan Sara Hidup 2020 benefit schedule

Fig 2: BPR 2021 vs BSH 2020 benefit levels, for a household earning below RM2,000/month

Building upon similar measures in the Prihatin/Penjana stimulus packages, Budget 2021 also proposes numerous EPF-related measures for 2021. The first is an initiative to allow a reduction in employee’s EPF contribution rates for employees from 11% to 9% starting from January 2021. At the same time, eligible individuals can withdraw RM500 a month from their EPF Account 1, and use Account 2 funds to make insurance purchases.

While these measures can provide some households with much-needed liquidity, on balance it risks being largely ineffective in safeguarding the welfare of low-income and marginalised households. Some 62 percent of working-age Malaysians are not covered by EPF or any other national pension program and as a result do not have EPF accounts to draw from. And even for those who are covered by EPF, about 32 percent of contributors only have less than RM5,000 in their Account 1–with some lower-income workers having even less than that. Additionally, drawing down funds from workers’ own future contributory retirement savings for current consumption will erode the social safety net protections afforded to workers meant for their old-age. As such, direct government spending on expanding and broadening social safety net programs like the Employment Insurance Scheme (EIS) unemployment benefits and BSH cash transfers are likely to have a far greater impact than EPF-related measures in cushioning the socio-economic impacts of the pandemic on lower-income households.

3.0 Technical and Vocational Education and Training (TVET) Programs

For 2021 a significant amount of allocation is distributed for TVET programs amounting to RM6 billion. Loans will be given to up to 24,000 employees both in the public and private skills training institutions which amounts to RM300 million through the Skills Development Fund Corporation. This allocation is RM100 million higher than the year before as the government anticipates the unemployment rate to be higher next year as businesses and employers continue to reel from COVID-19’s economic impacts well into 2021.

Incentives are also given to institutions and agencies who create and execute TVET programs here in Malaysia. However, the fundamental issues of the quality of the existing TVET programs and the need for reforms were not highlighted in the budget.

Additionally, efforts to streamlining and monitoring these programs were not emphasised during the tabling of the budget. Restructuring and reorganizing the existing TVET syllabus is key if we aspire to produce TVET graduates who are competitive not just locally but internationally as well. To do this the quality of our programs need to be improved significantly.

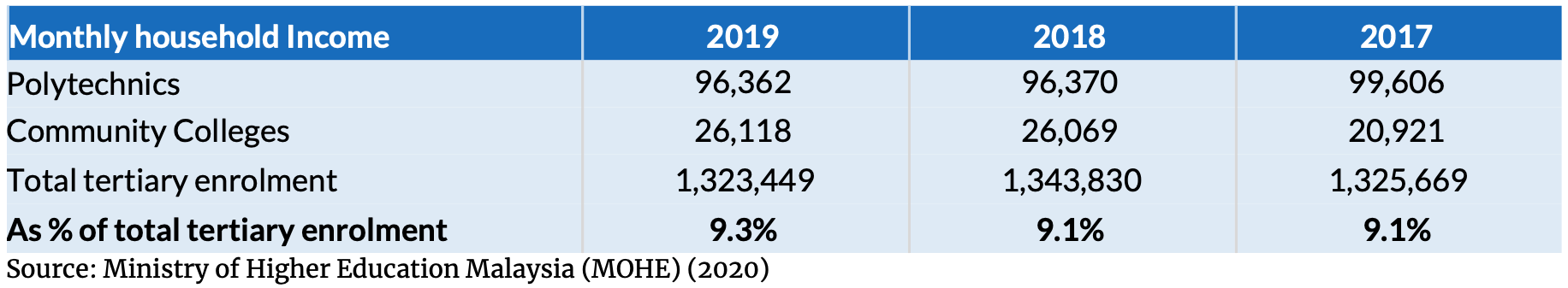

Table 6: Students Enrolment at TVET Tertiary Institutions Malaysia Excluding IKBN and MARA Colleges from 2017 – 2019

As upgrading the quality of TVET programs is still a big challenge and issue in Malaysia, enrolment rate into TVET programs is still very low as highlighted in the figure above. From 2017 to 2019, TVET enrolment rates did not surpass the 10 percent mark for polytechnics and community colleges. The negative mindset of employers, students and the public towards TVET programs is linked to the quality of these programs. As such, improving the quality of the existing programs will lead to increased enrolment rate and higher employability rate among TVET graduates in the country. This will then rectify the biases towards TVET graduates and programs in the long run.

To improve the quality of the TVET programs, both the government and private sectors need to play a role in upskilling and reskilling workers in Malaysia. To date, there are numerous Technical and Vocational Education and Training (TVET) programs provided by seven different ministries at certificate, diploma, and degree levels. This creates an issue of overlapping and redundancies. Consolidating these programs into fewer flagship programs, along with establishing rigorous, measurable monitoring and evaluation mechanisms can help in removing lower-performing programs and improving program administrative capacity.

4.0 Digitalisation and automation

In Budget 2021, there were large allocations towards promoting digitalisation and automation across different sectors for micro SMEs (MSMEs). Under the digital adoption objective, there is an allocation of RM150 million in grants with relaxed conditions for MSMEs and start-ups. A separate RM 150 million is distributed to encourage adoption of e-commerce in SMEs through training, sales assistance and digital equipment. In terms of automation and upskilling RM 230 million are allocated to financing SMEs especially for working capital and upgrading of automation systems.

In 2019, it was found that 98.5 percent of business establishments amounting to over 900,000 establishments in Malaysia are MSMEs. Given the nature of our MSME community and its challenges in securing financing especially during the pandemic for digital upgrading and adoption, the allocation is in line with the growing importance of the digital economy in Malaysia. Past experience during the early stages of the Movement Control Order (MCO) in March suggests that digital trade has been essential in creating employment and maintaining livelihoods of smallholders–and support is needed for the MSME community to give them opportunities to participate by equipping them with the proper knowledge, infrastructure and tools in the immediate term.

Additionally, the agriculture sector is receiving RM100 million for high impact and high value agriculture and livestock, while the fishery sector is allocated RM50 million for modernization of fishing vessels in upgrading their technology to increase productivity. While these efforts are very much welcome, there may be huge implementation challenges in ensuring that small-time farmholders and fishermen are able to reap the benefits from these allocations. UN Food and Agriculture Organisation (FAO) 2017 estimates suggest that there are about 132,305 fishermen and 21,156 workers engaging in aquaculture full-time. Yet, it is estimated that there are only about 49,640 decked motorized vessels–suggesting that an overwhelmingly large proportion of fishermen and aquaculture workers do not own their own fishing vessels. This highlights the potential for unequal access to budgetary allocations for these sectors. Vessel owners stand to benefit from this allocation while non-vessel owners may not necessarily have the capital to acquire the assets or technology to capitalise on these funds, potentially exacerbating income inequality between capital and non-capital owners.

5.0 Localisation of Sustainable Development Goals (SDGs)

It is also refreshing to note that in the 2021 Budget, in addition to the 12th Malaysia Plan, the government has pledged to allocate funding to localizing SDGs at the community level through the All Party Parliamentary Group Malaysia on Sustainable Development Goals (APPG-SDG) Framework, of which ISIS Malaysia is a partner institution of. This project is different from some other SDG related projects in that it includes an active role in engaging local stakeholders at the ground level, mapping local issues, seeking project-based solutions based on the 17 SDGs adopted in the UN’s 2030 Agenda for Sustainable Development.

In its first year of execution, the allocation has amounted to RM5 million for different constituencies in Malaysia to tackle issues concerning unemployment, decent jobs, income inequality, access to education and the environment. This is more than twice its size compared to the allocation given to the group in 2020, where more than 30 pilot solution projects and capacity projects are to be executed in 10 different constituencies across Malaysia including Sabah and Sarawak from 2020 to 2021.

The projects to be executed in the initial areas identified in Bentong, Tanjung Piai, Jeli, Papar, Pensiangan, Bandar Kuching, Batang Sadong, Selayang, Pendang and Petaling Jaya cover river clean-up drives, island waste management, biodiversity protection, organic farming and slum incubator among others. In 2021, the projects will be extended to other constituencies given the interest of the MPs and with the awareness among the communities and other stakeholders it is hoped that the 17 SDG goals can be pursued together at the ground level.