Jaideep Singh was quoted by Washington Post Intelligence on 5 November 2025

by Josh Rogin and Kendrick Frankel

New bilateral deals open lanes for U.S. industries and investors, but leave a maze of tariffs and uncertainty.

Key Takeaways

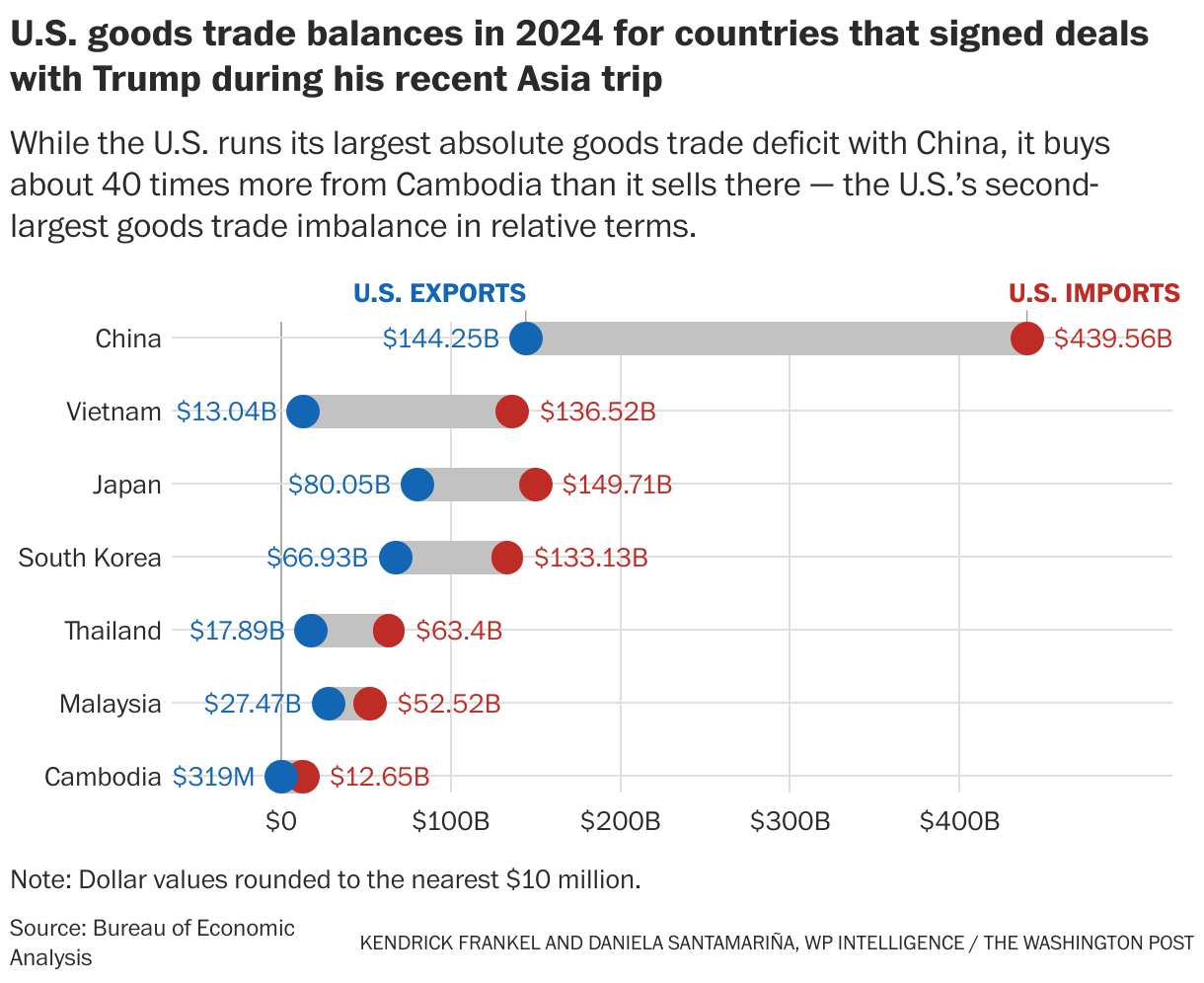

Trump’s trade tour reshapes the playing field. President Donald Trump’s 5-day trip through Asia last week produced a flurry of trade announcements redefining U.S. economic relations with the region. Trump’s new reciprocal trade deals with Malaysia, Thailand, Vietnam and Cambodia didn’t erase tariffs, but they did open lanes that favor certain U.S. exports and corresponding supply-chain flows in sectors ranging from agriculture to aviation to energy.

Southeast Asia gets modest relief and lingering uncertainty. New U.S. framework agreements with Southeast Asian partners bring only modest tariffs relief as most countries remain at 19 or 20 percent baseline rates. But the removal of nontariff barriers may open major channels for investment and sectoral cooperation. Malaysia and Cambodia agreed to adopt U.S. trade restrictions and align with U.S. enforcement against unfair trade practices by third countries. Thailand and Vietnam accepted frameworks on supply-chain resiliency, tariff evasion and export controls.

South Korea secures the trip’s biggest win. Seoul finalized a $350 billion investment framework and received Trump’s authorization to participate in shared manufacturing of nuclear-powered submarines in the Philadelphia shipyard owned by Korean conglomerate Hanwha, with South Korea getting access to nuclear-propulsion technology. This represents a strategic win for President Lee Jae Myung, who smartly appealed to Trump’s shipbuilding and defense-industrial priorities.

U.S.-China truce provides only temporary calm. Trump and Chinese President Xi Jinping met in South Korea on the sideline of the APEC CEO Summit. Beijing agreed to a one-year pause on export controls for rare earths and critical minerals. The U.S. government suspended some export restrictions and port fees for Chinese vessels. But semiconductor and digital-trade frictions are unresolved, and most insiders view the truce as a tactical timeout, not a durable peace.

Scarce details mean increased risk. The Southeast Asia agreements lack enforceable dispute-settlement mechanisms and clear implementation details. The Trump administration also hasn’t said how it will enforce a 40 percent penalty tariff for transshipped goods that originated in other countries. More sector-specific sanctions on items like semiconductors are coming soon. All of this uncertainty undermines the upside of these deals.

Summary: A China détente and a Southeast Asian reset

As Trump returned this week to Washington from his swing through Malaysia, Japan and South Korea, governments and executives around the region and in the United States were still parsing through the flurry of trade announcements emanating from the White House.

After the Trump-Xi meeting in the South Korean city of Busan, Treasury Secretary Scott Bessent cast the resulting agreement as a win for the United States. He told the Financial Times that “Beijing made a real mistake by threatening to shut off exports of its rare earths,” a reference to the Chinese threat to control the export of more than a dozen critical minerals. Still, most trade observers saw the arrangement as a draw, at best, that provided a short-term limited de-escalation in trade tensions while leaving much of Beijing’s leverage intact for future use.

The Trump administration used the trip to deepen coordination with other Asian partners, unveiling new trade and investment frameworks with Malaysia, Cambodia, Thailand and Vietnam. These deals keep the reciprocal-tariff structure of Trump’s “Liberation Day 2” Executive Order 14326 from August, but add operational provisions on customs enforcement, digital trade and intellectual property. They are designed to curb tariff evasion, address nontariff barriers, and limit the ability of third-country companies (read Chinese firms) to route around U.S. restrictions by moving their goods through Southeast Asia.

A new cooperation initiative with Japan on rare earth mineral production and a deal with South Korea to jointly manufacture nuclear-powered submarines are case studies in how Asian governments are learning to successfully deal with the Trump administration.

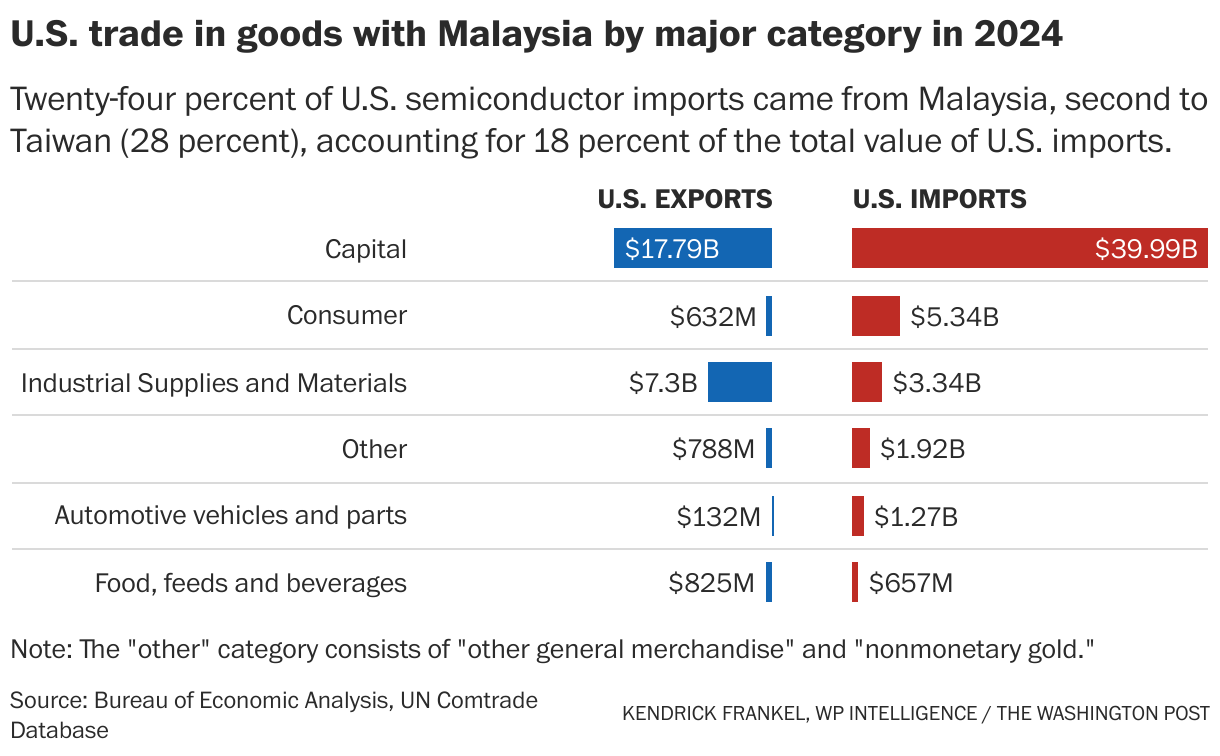

Wendy Cutler, vice president at the Asia Society Policy Institute and former U.S. trade negotiator, said Malaysia’s agreement is the most substantive. “The administration was able to secure high levels of market access to Malaysia, both through Malaysia agreeing to unilaterally cut many of its tariffs, but also through addressing a whole host of nontariff measures,” she noted, adding that the Trump team deserves kudos for its work in these areas.

Cutler said the deal introduces detailed economic security provisions directing Malaysia to align with U.S. policy on companies from third countries operating inside its borders. “The word China doesn’t appear in the Malaysia deal at all, but if you look at many of these provisions, it seems to be aimed at China,” she said. “This is fairly unprecedented.” Expect that precedent to become the new norm for Trump’s second term.

Analysis

China: Tactical truce, strategic fog

What Trump called the “G2” summit between him and Xi produced a one-year freeze on the escalating U.S.-China trade war, not a formal settlement. China paused new export restrictions on rare earths, while Trump held off on the threat of new tariffs and reduced China’s existing reciprocal rate by 10 percent. Both sides suspended port fees. The truce creates breathing room for the U.S. to continue developing alternative rare earth and critical mineral sources and supply chains.

For those tracking U.S. restrictions on technology exports to China, the result of the summit was mixed. Hawks were relieved that Trump did not lift current restrictions on the sale of high-level Blackwell semiconductors for China, thwarting the lobbying campaign led by the producer of those chips, Nvidia. But Trump did roll back new rules imposed just last month by his own Commerce Department that would automatically blacklist companies majority owned by already blacklisted companies. This reverses a move meant to close a big loophole that blacklisted Chinese firms exploit at will by routing business through their non-blacklisted subsidiaries. Even this temporary truce is fragile; the Trump administration has said it is planning to announce sectoral sanctions on semiconductors that could break the détente, if Beijing retaliates against the next wave of Trump trade actions.

Malaysia: Comprehensive but fragile

As the host of this year’s East Asian Summit, the Malaysian government was able to secure significant face time with Trump and strike a deal to stabilize its tari9 burden in exchange for a host of concessions long sought by Washington. Malaysia’s agreement keeps a 19 percent reciprocal tari9 but removes a wide set of barriers to U.S. goods, including chemicals, passenger vehicles, machinery, and meat and dairy products. It commits to facilitating digital trade with the U.S., including exemptions from digital-services taxes or restrictions. It pledges strengthened intellectual-property enforcement and a ban on imports made wholly or in part with forced labor.

On customs enforcement, Malaysia agreed to combat transshipment and other duty- evasion practices through a duty-evasion cooperation agreement. The framework provides for the establishment of “rules-of-origin” requirements, which would identify where the components of goods are coming from, in order to prevent tariff evasion. Malaysia also pledged to regulate sensitive technologies, screen inbound investments related to critical minerals and infrastructure, and coordinate with Washington on economic-security issues.

But the Malaysia deal does not address the sector based semiconductor tariffs Trump is planning to announce. And because the agreement does not contain any dispute resolution mechanism, Malaysians fear Trump could reimpose harsh tariffs any time he perceived Malaysia is not living up to its side, said Jaideep Singh, an analyst with the Institute of Strategic & International Studies Malaysia

“At the moment, the reaction in Malaysia has been sort of mixed,” he said. “Businesspeople have been more positive to the agreement because there was a lot of confusion and uncertainty when the so-called preliminary framework deal was announced and this agreement at least puts commitments on paper.”

This article was first published in Washington Post Intelligence, 5 November 2025