Dhana Raj Markandu was quoted in The Malaysian Reserve, 9 September 2024

By Aufa Mardhiah

AS MORE countries incorporate nuclear energy into their main strategy to combat climate change, Malaysia has come under intense pressure to revive its abandoned nuclear programme.

Analysts and experts are adamant that the country has a leading edge in terms of nuclear talent and infrastructure, making it well-positioned to renew Malaysia’s nuclear power project as advancing technologies ensure that conventional risks are well contained.

While conventional nuclear power projects require high capital and long periods of planning and construction, investments in small modular reactors (SMRs) could efficiently supply electricity directly to remote areas and industrial zones.

SMRs, capable of producing around 300 Megawatts of electricity, could be integrated into existing building infrastructures or connected to the national grid with a relatively smaller footprint and cost.

PFYN Capital MD Patrick Franz, a partner of Trident Investment Luxembourg, said that Malaysia has an enormous potential to adopt advanced nuclear energy technologies to become a leader among its regional peers.

There is a strong case for the country to consider SMRs to further diversify the energy mix, similar to more advanced economies such as France and Sweden.

Citing France, Franz said that the country had relied extensively on nuclear energy for over 60 years.

During peak periods, nuclear power has contributed up to 75% of the country’s energy production. It currently accounts for around 65% of the nation’s power generation capability, Franz told The Malaysian Reserve recently.

Sweden, in the meantime, currently uses 30% nuclear, 40% hydro and 20% wind-based energy.

At the 28th Conference of the Parties (COP28) last year, 22 nations decided to incorporate nuclear energy into their strategies to combat climate change.

The move was one of the strongest endorsements for the nuclear industry, with these nations integrating nuclear power into their energy frameworks.

Franz said that even hydrocarbon-rich countries in the Middle East are focusing on nuclear energy to diversify their energy supply.

The United Arab Emirates (UAE) has began investing in nuclear power since 2009, setting up a regulatory body and constructing a state-of-the-art nuclear power plant.

The Barakah Nuclear Energy Plant now provides around 25% of UAE’s energy needs, supporting desalination plants and steel manufacturing, and reducing dependence of fossil fuel.

“Many countries are shifting away from hydrocarbon in favour of nuclear power, particularly with advancements in advanced SMRs. These reactors provide power directly where needed, avoiding the high costs associated with extensive power grid connections.

“Moreover, nuclear power has the lowest mortality rate among energy sources, making it one of the safest ways to produce power,” he asserted, based on statistics published by the International Atomic Energy Agency (IAEA) and the World Nuclear Association.

Meanwhile, as Malaysia transitions away from coal, the Institute of Strategic and International Studies senior analyst Dhana Raj Markandu noted that the country dependence on gas, hydro and solar energy would increase.

However, both hydro and solar power are weather-dependent.

Climate change could impact expected weather patterns and solar irradiance, posing systemic risks.

Hence, nuclear energy is a viable option to diversify the energy mix and provide a stable baseload electricity source.

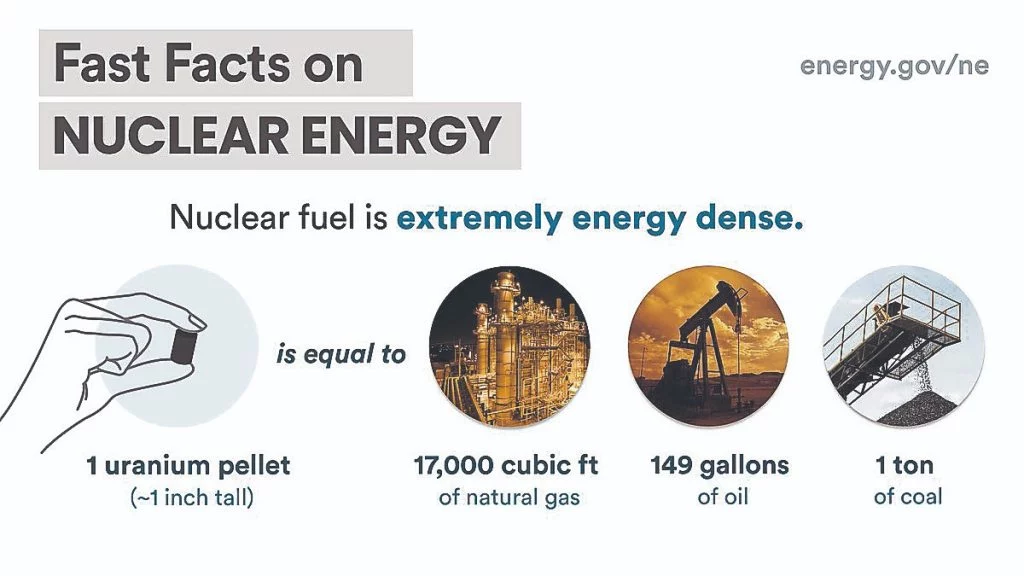

In terms of sustainability, Dhana explained that nuclear energy is a dense energy source, requiring small amounts of fuel to produce large amounts of stable electricity.

Its land use footprint is comparable to existing fossil fuel plants, which are smaller than what is required for renewables like wind and solar.

Thus, nuclear plants can displace fossil fuel plants without the associated carbon emissions.

“The high energy density and long lifespan of nuclear energy mean it requires fewer raw materials and resources per unit of energy, making it more sustainable in the long term,” he told TMR.

Moreover, nuclear is the only electricity source that internalises the cost of its entire lifecycle, including waste management and decommissioning, right from the planning stage.

Nuclear energy has the potential to provide a stable electricity supply as it is not intermittent or weather-dependent.

Its contribution to the energy mix will depend on the number of feasible plants, economic and financial constraints, grid capability, and other sources’ availability.

In this matter, Dhana highlighted that Malaysia could achieve cleaner electricity generation like Sweden.

“Currently Malaysia’s energy generation is vastly different to the one in Sweden; however, it could be achieved by integrating nuclear energy,” he added.

Malaysia’s History on Nuclear

Tracing back to the government’s stance on nuclear, Universiti Tenaga Nasional’s (UNITEN) Institute of Nuclear Energy director Dr Mohd Syukri Yahya noted that Malaysia has developed a significant pool of local nuclear talent and has safely operated nuclear research reactors for over four decades.

From 2011 to 2019, Malaysia pursued nuclear power and established a Nuclear Energy Programme Implementing Organization (NEPIO) following IAEA guidelines.

Albeit the disbandment of the NEPIO in 2019, he said the IAEA recognised Malaysia’s efforts as exemplary for newcomer countries and identified areas for improvement should Malaysia decide to adopt nuclear power.

Mohd Syukri said that Malaysia should reconsider its interest in nuclear energy.

With the advancements in technology and the gradual phasing out of fossil fuels, Malaysia “have no choice but to revisit nuclear energy as a viable option,” he asserted.

He further highlighted that within ASEAN, Singapore has already signed the 123 Agreement with the US, while Thailand signed an MoU with China for nuclear cooperation in 2010.

Both the Philippines and Indonesia have signed MoUs with the US in 2022, with the Philippines exploring the potential for nuclear energy development, and Indonesia focusing on developing its own SMRs.

“Our neighbours are considering exploring nuclear energy. Like it or not, nuclear power will come to our region.

“If we don’t equip ourselves with knowledge about nuclear energy — firstly, we will be left behind; secondly, if anything happens around us, we won’t know how to handle the situation; and thirdly, if we don’t sign international agreements, we won’t be included among the countries that receive nuclear liability coverage,” he told TMR.

Nuclear energy takes time to develop, and its financial model differs from other energy sources. It involves a higher initial capital cost and a longer return on investment (ROI), typically around 10-12 years, although the technology itself lasts about 60 years.

“Meaning, we spend a lot of capital expenditure in year one, then we have to wait for 12 years before getting our ROIs. But from year 13 to 60, which is approximately 47 years, the returns are substantial, making it highly profitable,” he further explained.

He also noted modern nuclear reactors’ safety with proven waste management protocols.

He said leveraging the experience from the 2019 NEPIO, Malaysia is well-positioned to integrate nuclear power into its energy mix, complementing renewable energy (RE) sources and supporting the National Energy Transition Roadmap (NETR).

Meanwhile, Dhana said the government’s decision to not pursue nuclear energy in 2018 for electricity generation continues to hold, as nuclear energy is not included in the NETR.

According to him, the primary environmental concern associated with nuclear energy in Malaysia is the long-term management of radioactive spent fuel.

Hence, robust governance measures and stringent regulations are essential to ensure a high level of safety, security and safeguards.

Despite the energy source being a taboo topic for Malaysians incorporating nuclear energy could significantly lower the emissions intensity of Malaysia’s electricity supply.

“Nuclear power plants’ operating costs are not affected by fossil fuel price volatility, with uranium being a relatively minor cost component compared to coal or gas. This stability could result in domestic energy prices being less prone to external fluctuations.

“The construction, operation, and maintenance of nuclear power plants would create numerous jobs, especially in the Science, Technology, Engineering and Mathematics (STEM) fields, thereby enhancing local technical competencies,” he said.

Investment in Malaysia’s Nuclear Sector

Despite public scepticism, Franz said nuclear power statistically has lower mortality rates than other energy sources, even considering incidents like Chernobyl and Fukushima, which were caused by human error and extraordinary natural events respectively. To counter similar situations, he believes modern nuclear plants are designed to mitigate such risks.

With countries like Japan resuming nuclear programmes to meet high energy demands, Franz said it serves as a testament that nuclear power provides a reliable baseload.

This capability effectively complements renewable sources such as solar and wind.

For this, Trident Investments Luxembourg has identified Malaysia as a largely untapped opportunity in the energy sector.

Malaysia’s nuclear energy sector is still in its early stages of development and research, said Franz.

This presents a scenario similar to how some nations leapfrogged directly from no telephone infrastructure to mobile phones, bypassing landlines altogether.

“Malaysia has the potential to swiftly adopt advanced energy technologies and could become a leader in nuclear technology among its regional partners.”

Franz highlighted that investing in these SMRs could be especially advantageous for remote areas in Malaysia that currently rely on diesel generators or coal-fired plants, which have high carbon footprints.

Additionally, he said SMRs could be integrated into existing infrastructure, such as petrochemical plants or large office buildings in Kuala Lumpur.

This would provide a sustainable and reliable power source while eliminating the need for extensive power line infrastructure and reducing reliance on fossil fuels.

Franz said rather than constructing large-scale nuclear power plants and developing extensive infrastructure, which can be costly and prone to budget overruns, it is more efficient to deploy SMRs near industrial hubs.

The method, according to him, ensures that energy is supplied directly to heavy industry sites without the need for massive infrastructure investments.

In terms of aligning with Malaysia’s “Meaning, we spend a lot of capital expenditure in year one, then we have to wait for 12 years before getting our ROIs. But from year 13 to 60, which is approximately 47 years, the returns are substantial, making it highly profitable,” he further explained.

He also noted modern nuclear reactors’ safety with proven waste management protocols.

He said leveraging the experience from the 2019 NEPIO, Malaysia is well-positioned to integrate nuclear power into its energy mix, complementing renewable energy (RE) sources and supporting the National Energy Transition Roadmap (NETR).

Meanwhile, Dhana said the government’s decision to not pursue nuclear energy in 2018 for electricity generation continues to hold, as nuclear energy is not included in the NETR.

According to him, the primary environmental concern associated with nuclear energy in Malaysia is the long-term management of radioactive spent fuel.

Hence, robust governance measures and stringent regulations are essential to ensure a high level of safety, security and safeguards.

Despite the energy source being a taboo topic for Malaysians incorporating nuclear energy could significantly lower the emissions intensity of Malaysia’s electricity supply.

“Nuclear power plants’ operating costs are not affected by fossil fuel price volatility, with uranium being a relatively minor cost component compared to coal or gas. This stability could result in domestic energy prices being less prone to external fluctuations.

“The construction, operation, and maintenance of nuclear power plants would create numerous jobs, especially in the Science, Technology, Engineering and Mathematics (STEM) fields, thereby enhancing local technical competencies,” he said.

Investment in Malaysia’s Nuclear Sector

Despite public scepticism, Franz said nuclear power statistically has lower mortality rates than other energy sources, even considering incidents like Chernobyl and Fukushima, which were caused by human error and extraordinary natural events respectively. To counter similar situations, he believes modern nuclear plants are designed to mitigate such risks.

With countries like Japan resuming nuclear programmes to meet high energy demands, Franz said it serves as a testament that nuclear power provides a reliable baseload.

This capability effectively complements renewable sources such as solar and wind.

For this, Trident Investments Luxembourg has identified Malaysia as a largely untapped opportunity in the energy sector.

Malaysia’s nuclear energy sector is still in its early stages of development and research, said Franz.

This presents a scenario similar to how some nations leapfrogged directly from no telephone infrastructure to mobile phones, bypassing landlines altogether.

“Malaysia has the potential to swiftly adopt advanced energy technologies and could become a leader in nuclear technology among its regional partners.”

Franz highlighted that investing in these SMRs could be especially advantageous for remote areas in Malaysia that currently rely on diesel generators or coal-fired plants, which have high carbon footprints.

Additionally, he said SMRs could be integrated into existing infrastructure, such as petrochemical plants or large office buildings in Kuala Lumpur.

This would provide a sustainable and reliable power source while eliminating the need for extensive power line infrastructure and reducing reliance on fossil fuels.

Franz said rather than constructing large-scale nuclear power plants and developing extensive infrastructure, which can be costly and prone to budget overruns, it is more efficient to deploy SMRs near industrial hubs.

The method, according to him, ensures that energy is supplied directly to heavy industry sites without the need for massive infrastructure investments.

In terms of aligning with Malaysia’s crucial to identify key economic players with significant carbon footprints, namely petrochemical companies, fertiliser producers and electricity generators, that currently rely on coal-fired energy.

By collaborating with these entities, Trident Investments Luxembourg aims to phase out coal-fired plants and replace them with SMRs.

Franz further highlighted numerous instances where energy companies have successfully implemented SMRs, demonstrating their potential to contribute significantly to Malaysia’s carbon-neutral journey.

However, the transition requires substantial capital investment.

A feasible approach could involve a combination of public-private partnerships.

Funding opportunities could come from Malaysia’s sovereign wealth funds, contributions from petrochemical companies that benefit from decarbonising their supply chains and investment houses like Trident Investments Luxembourg.

Given their long-term nature, he believes these projects promise returns over several decades, benefitting all stakeholders involved in building the critical infrastructure.

Trident Investment Luxembourg, a Reserved Alternative Investment Fund based in Luxembourg, specialises in the sustainable energy sector and benefits from a flexible investment structure and PFYN Advisory Pte Ltd, a company initially established as an advisory firm in Singapore and later PFYN Capital AG.

Managed by PFYN Capital in Geneva, the firm evaluates projects like SMRs, enrichment, conversion and mining operations.

Trident’s investment strategy includes recycling nuclear fuel and managing non-recyclable materials, securing an equity stake in mining operations and ensuring capabilities in fuel production, conversion and enrichment.

This comprehensive approach ensures a stable and secure fuel supply chain, crucial for the continuous operation of nuclear reactors.

Trident plans to integrate nuclear power into Malaysia’s existing and future renewable energy (RE) infrastructure by deploying microreactors in remote areas.

This innovative approach could showcase to neighbouring countries like Indonesia, the Philippines, Cambodia and Thailand the feasibility of providing reliable electricity to remote regions, thereby enhancing energy security and reducing carbon footprint.

Additionally, Malaysia’s existing coal plants present a unique opportunity for repurposing; by replacing coal plant sites with nuclear reactors, the existing grid infrastructure can be utilised without extensive modifications, facilitating a seamless transition and minimising the need for significant new investments.

Franz noted that petrochemical companies in Malaysia are assessing their energy consumption and identifying suitable reactor types could lead to notable advancements in energy efficiency.

Collaborating with the Malaysian government and the private sector on these initiatives could significantly contribute to the country’s energy landscape.

Apart from that, the firm’s vision involves actively contributing to the country’s energy security, supporting decarbonisation stratgies and fundamentally transforming energy production.

The effort is expected to drive incremental GDP growth, as the nuclear power industry requires highly skilled labour and offers high-income potential.

Furthermore, building and exporting reactors can substantially boost economic growth.

Beyond economic benefits, the firm’s mission is rooted in sustainable energy solutions and contributing to global environmental goals, with investments in uranium mining, conversion, enrichment and reactor operations playing a crucial role in decarbonization.

Over the next decade, Franz said the firm envisions working with Malaysia to secure investments for the fuel supply chain and determine the most suitable reactor technology for operational needs.

Additionally, the firm aims to enhance learning and share knowledge with Malaysian universities and institutions.

The initiative will benefit Malaysia and facilitate the export of expertise to neighbouring countries.

“The most exciting aspect of nuclear energy is its openness to new participants and its potential to enhance global energy security.

“Despite being a relatively small and opaque industry, nuclear energy welcomes investment and operational interest,” Franz said.

He believes the future of energy should be viewed as a portfolio of solutions, with nuclear energy playing a crucial role alongside other sources like hydroelectric power.

The nuclear industry’s collaborative approach aims to demonstrate how nuclear energy can complement other energy models, focusing on finding the right solution for each situation.

Although the initial investment in nuclear energy may be significant, the long-term benefits include decades of stable and clean energy, ultimately changing perceptions and securing a sustainable energy future for the next generations.

Is Nuclear Energy Really Safe?

Contrary to public misconceptions and fears, Franz said nuclear energy is one of the safest energy sources available today.

He emphasised that the industry has advanced significantly through various generations of reactor designs, from Generation 1 to the current Generation 3+ and Generation 4 reactors.

Modern reactors incorporate rigorous safety measures to mitigate risks.

Concerns about potential attacks on nuclear reactors are addressed with robust design features and these reactors are built to withstand significant impacts, ensuring their structural integrity and safety.

In the local context, UNITEN is developing a novel reactor core design that is inherently safe and efficient.

Mohd Syukri said the university is also considering fusion power reactors as a future power source and collaborating with local partners to advance these innovations.

In its research efforts, UNITEN is designing a new nuclear reactor that prioritises safety and efficiency, potentially utilising local nuclear resources like thorium.

The university is also exploring the ergonomic aspects of reactor operation, developing a hybrid nuclear-renewable system tailored to the local climate and demand and conducting nuclear education and public awareness campaigns.

Additionally, UNITEN is working on exposure dosage determination at thermal power plants.

Apart from that, Mohd Syukri highlighted the university’s close collaboration with the IAEA, Japan, China and other regional institutions.

The university is a full member of the International Nuclear Security Education Network (INSEN) and the Institute of Nuclear Science and Technology Academy (INSTA), among others.

In terms of awareness and public perception, the three experts agreed that the negative mindset surrounding nuclear energy needs to be changed by the information shared with the masses.

Dhana believes that public perception issues include the assumption that renewables alone can meet future energy needs and concerns about nuclear energy’s safety, security, waste, proliferation and cost.

Addressing these concerns, according to him, requires transparent communication, continuous stakeholder engagement and a strong regulatory framework.

Politically, adopting nuclear energy involves a long-term commitment, as planning and constructing a nuclear power plant takes about a decade, with the plant operating for another six decades or more, followed by decommissioning.

Therefore, he said effective long-term governance and oversight frameworks are crucial for nuclear energy adoption in Malaysia.

Current State of Malaysia’s Nuclear Sector

As of 2024, Malaysia’s nuclear energy sector is witnessing renewed interest and development, driven by the government’s goal to achieve carbon neutrality by 2050. Recognising that RE sources alone may not suffice to meet baseload power requirements, nuclear energy is being reconsidered as a viable alternative.

Malaysia had previously postponed its nuclear plans in 2018, but recent efforts under NETR aim to increase RE capacity to 70% by 2050.

The IAEA has recognised Malaysia’s preparedness for nuclear power, suggesting further steps for infrastructure development.

Significant investments, including over RM700 billion in RE, underscore Malaysia’s commitment to transitioning to a green economy, with nuclear power playing a crucial role in providing reliable, low-carbon baseload energy.

In July 2023, Natural Resources and Environmental Sustainability Minister Nik Nazmi Nik Ahmad said Malaysia will maintain its no-nuclear power policy due to environmental concerns.

Although he acknowledged the potential of SMRs, he emphasised that the government does not plan to explore nuclear power generation at this time — citing the need to convince the public and address environmental concerns before considering nuclear energy as part of Malaysia’s energy mix.

However, in 2024, there seems to be a shift in Malaysia’s opinion towards nuclear as another option for its energy mix.

At the launch of the NETR, Economy Minister Rafizi Ramli mentioned that Malaysia is open to the idea of nuclear power generation, but a thorough consideration is needed before it can be included in the country’s energy portfolio.

Nik Nazmi later echoed the sentiment to add that the government is evaluating the inclusion of nuclear enery in alignment with Malaysia’s zero-carbon emission goals.

Nevertheless, Mohd Syukri concurred on the necessity to fortify Act 304, which governs atomic energy activities in Malaysia.

He emphasised that the Act should be revised to comply with current international standards, thereby safeguarding national interests and rights.

“The Act must strengthen our nuclear regulator, Jabatan Tenaga Atom (Atom Malaysia), to ensure they have the power and mandate to do their job properly, especially when it comes to nuclear power deployment.

“Atom Malaysia must be restructured as a commission, a-la US Nuclear Regulatory Commission, to guarantee its independence and transparency,” he said.

Now, with the race towards 2050 and the limited energy options available, whether the government will incorporate nuclear energy into the country’s energy mix remains unconfirmed.

This article first appeared in The Malaysian Reserve weekly print edition